Supply and Demand

Definition

Supply and Demand represents the relationship between the availability of a product or service (supply) and the desire for that product or service (demand). Market prices tend to adjust until supply equals demand—forming an equilibrium point.

Daily Life Example

- Suppose you want to buy fresh strawberries at the local farmer’s market. Early in the season, when only a few farmers offer strawberries (limited supply) and many people want them (high demand), the price is likely to be higher. Later in the season, when more farmers harvest and sell strawberries (greater supply), the price often drops because demand can be met more easily.

Business Example

- A technology company releases a new smartphone model. Limited initial production (low supply) paired with massive consumer interest (high demand) might cause the phone to sell at a premium or sell out immediately. Over time, as manufacturing ramps up and competing brands release similar products, prices may stabilize or drop because of increased supply and more balanced demand.

Opportunity Cost

Definition

Opportunity Cost is the value of the next-best alternative you forgo when making a choice. It is not limited to money; it can also apply to how you spend your time, energy, or any other resource.

Daily Life Example

- If you have two hours of free time in the evening, you could use it to exercise, learn a new skill, or watch TV. When you pick one activity, the “cost” is the benefit you would have gained from the alternative you didn’t choose—like improved health from working out or knowledge from studying.

Business Example

- A startup with a limited budget has to decide whether to invest in a new marketing campaign or improve an existing product feature. If they choose the marketing campaign, the opportunity cost is the user satisfaction (and potential retention) they might have gained by enhancing the product. Evaluating opportunity costs ensures businesses allocate capital and effort toward initiatives with the best overall return.

Economies of Scale

Definition

Economies of Scale occur when increasing production volume results in a lower cost per unit. This typically happens because fixed costs—like machinery or research and development—can be spread over a larger number of items, leading to greater efficiency and profitability.

Daily Life Example

When you buy grocery items in bulk at a wholesale store, the price per unit (per ounce or per item) often becomes cheaper. This is because distribution, packaging, and handling costs are spread across a larger quantity, lowering the average cost of each unit.

Business Example

A car manufacturer invests heavily in advanced robotics for its assembly line. Initially, the setup is expensive (a high fixed cost), but as production ramps up and thousands of cars are built, the cost per car decreases significantly. This means the company can offer competitive pricing while still profiting from large-scale operations.

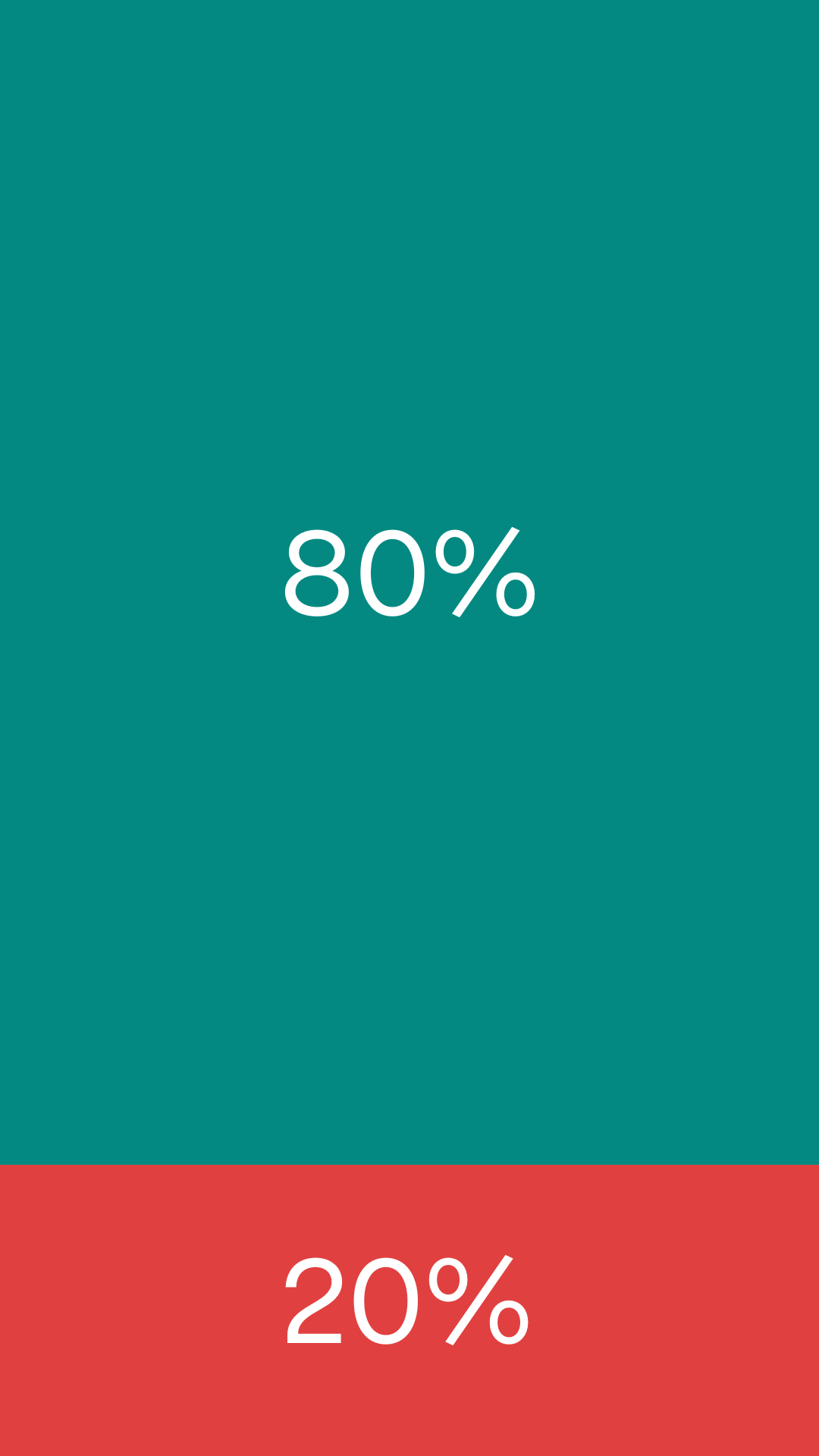

Pareto Principle

Definition

The Pareto Principle observes that roughly 80% of outcomes often result from 20% of causes. This ratio can shift (e.g., 70/30, 90/10), but the key idea is that the majority of results come from a minority of inputs.

Daily Life Example

You might notice that only a handful of your daily habits—like getting enough sleep and maintaining a healthy diet—generate the majority of your overall well-being. Conversely, a small number of negative habits may be responsible for the bulk of your stress or health issues.

Business Example

In sales, a company may find that 80% of its revenue comes from the top 20% of its customers. Armed with this insight, management can focus more resources on nurturing those high-value customer relationships and expanding similar segments, rather than spreading efforts evenly across the entire market.

Law of Diminishing Returns

Definition

The Law of Diminishing Returns states that if you keep adding inputs (such as labor, capital, or time) to a process, the incremental gains in output will eventually begin to decrease, after an optimal point.

Daily Life Example

Studying for an exam illustrates this principle. During the first few hours, your knowledge improves significantly. But as you push on without breaks—beyond the optimal study threshold—your ability to absorb information weakens, and each additional hour yields fewer benefits.

Business Example

A software development team might initially speed up project completion by adding more programmers. However, after a certain point, each additional team member may actually slow the process due to coordination overhead, communication barriers, and management complexity. The productivity gains per added developer diminish and can even become negative if the team becomes too large.

Time Value of Money

Definition

The Time Value of Money (TVM) concept asserts that a sum of money is worth more now than the same amount in the future because it can earn interest, be invested, or otherwise used to generate additional value over time.

Daily Life Example

If someone offers you $500 today or $500 in one year, taking the money now is generally more valuable. You can invest it in a savings account, stocks, or even use it for immediate needs, thus potentially increasing its worth or improving your quality of life earlier.

Business Example

When evaluating a capital investment (such as buying new equipment), companies often calculate Net Present Value (NPV) or Internal Rate of Return (IRR) to factor in how quickly future cash flows will convert to present-day value. Projects that generate cash sooner are typically more attractive because money can be reinvested more quickly.